The Statement Which Best Describes the Relationship Between the Premiums

Which of the following items is a model that describes the relationship between risk and expected return in this model the expected return is equal to the risk-free return plus a premium based on the systematic risk of the security. 1 Which of the following statements is FALSE.

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

E R i expected return of investment R f risk-free rate β i beta of the investment E R m R f.

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

. TermThe statement which best describes the relationship between the premiums of a whole life policy and the premium payment period is The shorter the payment period the higher the premium. E R i R f β i E R m R f where. The statement which best describes the relationship between the premiums of a whole life policy and the premium payment period is The shorter the payment period the lower the premium The longer the payment period the higher the premium The shorter the payment period the higher the premium The payment period has no affect on the premium payment.

The statement which best describes the relationship between the premiums of a whole life policy and the premium payment period is Equity index whole life The type of policy where 80 to 90 of the premium is invested in traditional fixed income securities and the remainder of the premium is invested in contracts tied to a stipulated stock index is equity index whole life. Which one of the following statements concerning the relationship between premium and loss ratio is true. The net income figure in the income statement is added to the retained earnings line item in the balance sheet which alters the amount of.

Which of the following statements is CORRECT. If the stocks beta is. ISTQB Dumps 2022 with answers 100 Sure Pass ISTQB Foundation Level Study Materials prepared by ISTQB Guru.

The Capital Asset Pricing Model CAPM is a model that describes the relationship between expected return and risk of a security. The least expensive option to pay off a 30-year mortgage balance would be. It has a zero.

Ignoring the scatterplot could result in a serious mistake when describing the relationship between two variables. The mode and median will fall in the center of. Plot 2 shows a strong non-linear relationship.

15 of the following items is a model that describes the relationship between risk and expected return in this model the expected return is equal to the risk-free return plus a premium based on the systematic risk of the security. The shorter the payment period the higher the premium. Under HIPAA requirements eligibility for the pre-existing conditions exclusion waiver under new coverage is lost if.

13 - Health Accident. CAPM formula shows the return of a security is equal to the risk-free. It has a zero current interest yield.

CAPM formula shows the return of a security is equal to the risk-free return plus a risk premium based on the beta of that security. There is a break in coverage of more than 53 days. Full Study Materias for ISTQB Foundation Level 2018 Syllabus.

Download Free PDF and ISTQB Mock tests for Indian Testing Board BCS UKTB ASTQB iSQI GASQ SASTQB CSTB CTFL_Syll2018 exam. C The yield curve is a potential leading indicator of future economic growth. With a whole life policy the shorter the payment period the higher the annual premium.

Paying out approximately 103 in claim related expenses for every 100 it collects in premium. There is a break in coverage of more than 33 days. The financial statements are comprised of the income statement balance sheet and statement of cash flows.

Required rate of return Risk-free rate of return Risk premium A risk premium is a potential reward that an investor expects to receive when making a risky investment. The yield to maturity on a coupon bond that sells at its par value consists entirely of a current interest yield. In the CAPM Capital Asset Pricing Model CAPMThe Capital Asset Pricing Model CAPM is a model that describes the relationship between expected return and risk of a security.

Beta compared with the equity risk premium shows the amount of compensation equity investors need for taking on additional risk. A The relationship between the investment term and the interest rate is called the term structure of interest rates. Capital asset pricing model.

B Real interest rates indicate the rate at which your money will grow if invested for a certain period. Plot 1 shows little linear relationship between x and y variables. Download latest ISTQB Dumps 2022.

The statement which best describes the relationship between the premiums of a whole life policy and the premium payment period is. The mode will always be the smallest value while the mean and median will be the same. The yield to maturity for a coupon bond that sells at a premium consists entirely of a positive capital gains yield.

Importance of Experiments 14 In a normal distribution which statement best describes the relationship between mean median and mode. The statement which best describes the relationship between the premiums of a whole life policy and the premium payment period is The shorter the payment period the lower the premium The longer the payment period the higher the premium The shorter the payment period the higher the premium The payment period has no affect on the premium payment. The relationship between risk and required rate of return can be expressed as follows.

Which one of the following statements best describes how the analyst can interpret this information for the year. The mean median and mode will all be in the middle of the distribution. For investments with equity risk the risk is best measured by looking at the variance of actual returns around the expected return.

These three statements are interrelated in several ways as noted in the following bullet points. Capital asset pricing model. There is a break in coverage of more than 43 days.

Pearsons linear correlation coefficient only measures the strength and direction of a linear relationship.

/modular-vs-manufactured-home-insurance-5074202_final-fdb217e866f84bdda6418d6c68e4c267.png)

Understanding Facultative Vs Treaty Reinsurance

What The Rule Of 72 Is And How It Works

How To Forecast Financial Statements Balance Sheets Income Statements

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

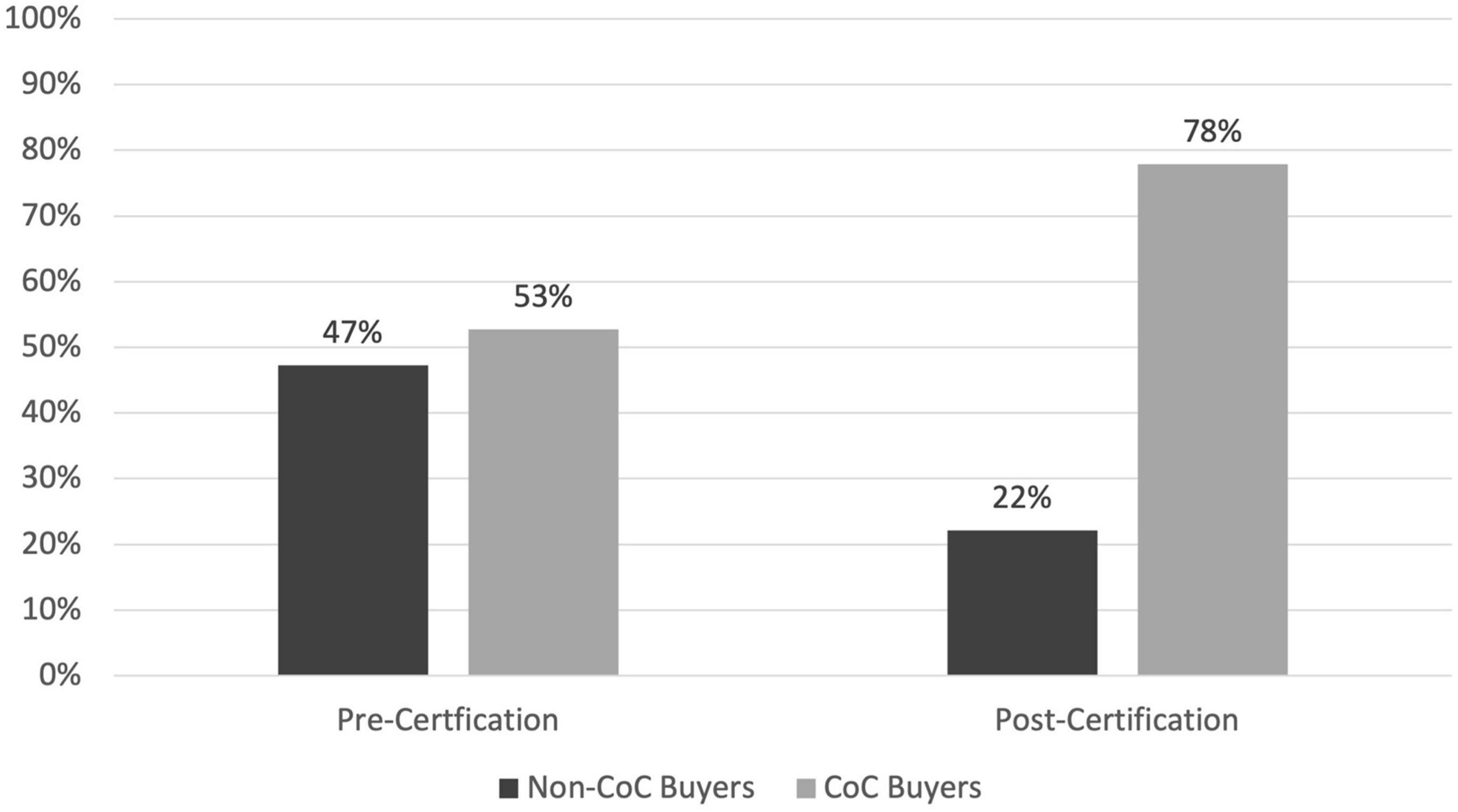

Frontiers Social And Economic Outcomes Of Fisheries Certification Characterizing Pathways Of Change In Canned Fish Markets Marine Science

Look What I Found On Wayfair Jute Area Rugs Jute Rug Jute Wool Rug

Infographic What Is Mortgage Insurance Http Www Leaderscorpfinancial Com Infographic What Is Mortgage Mortgage Marketing Mortgage Payoff Mortgage Tips

Shared Prosperity Monitoring Inclusive Growth

Amazon Com Dc Collectibles Batman Arkham Knight Batman Statue Toys Games Batman Statue Dc Collectibles Arkham Knight

2018 Cyber Defenders 29 Startups Cybersecurity Infosec Digitaltransformation Security Innovation Privacy Iiot B Cyber Security Human Security Cyber

Why Is My Block Buildings Insurance Premium Rising Deacon

Pin On Fbi Statedepartment Crimescene Cybercrime Stalking Abuseofpower Idampan Dylanimp Wilst Idamariapan Interpol Pan Not Peterpan T

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

Predictive Analytics In Insurance Types Tools And The Future

Sample Affidavit Example Business Template Things To Know Example

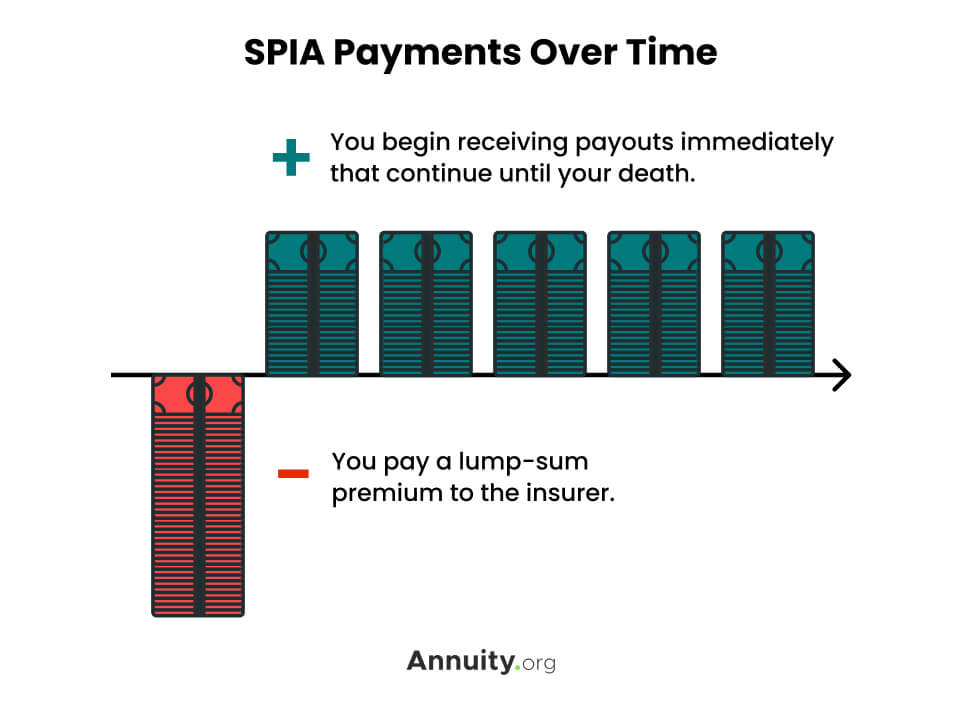

Single Premium Immediate Annuity Spia Rates Pros Cons

What Happens To Pension Policies And Life Assurance Policies The Deceased Held At Death Low Incomes Tax Reform Group

Comments

Post a Comment